Avoid These Pitfalls When Applying to Hard Money Lenders Atlanta

Wiki Article

How It Functions: A Comprehensive Guide to Hard Cash Loaning

Hard cash providing serves as an one-of-a-kind financing alternative, mostly driven by the value of actual estate rather than borrower credit reliability. This method allures to investors looking for quick accessibility to capital for different tasks. Comprehending the intricacies of difficult cash fundings is essential for prospective borrowers. What elements should one take into consideration before seeking this course? The following areas will certainly decipher the subtleties of tough money financing, giving clarity on its functions and effects.What Is Tough Cash Financing?

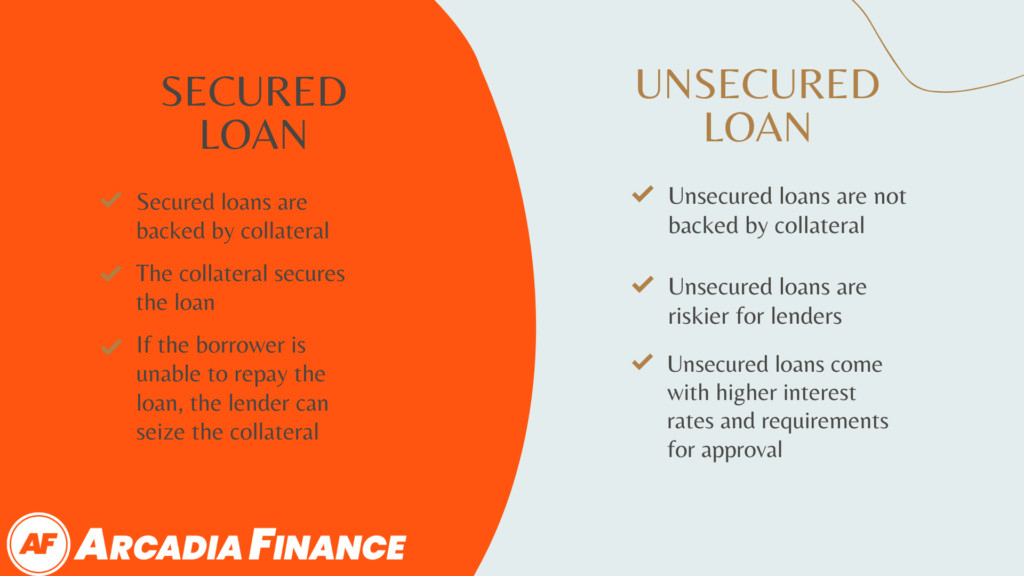

Difficult cash lending refers to a kind of funding secured by genuine home, commonly used by debtors that call for quick access to capital. Unlike standard financings, hard money fundings are largely based upon the worth of the collateral instead of the customer's creditworthiness. This type of funding is usually made use of by realty designers, individuals, or financiers seeking to acquire homes quickly, especially in affordable markets.Hard money loan providers are normally personal investors or companies that supply temporary loans, which can vary from a couple of months to a few years. Rates of interest on these loans often tend to be greater compared to conventional loans as a result of the boosted danger related to them. Additionally, the authorization process for hard cash finances is generally quicker, making them an attractive option for those in immediate monetary situations. Recognizing the principles of hard cash loaning is important for possible debtors considering this financing alternative.How Tough Money Lendings Function

Comprehending just how difficult money financings operate is necessary for possible borrowers. These financings are usually short-term financing alternatives secured by realty. Unlike conventional financings that count on credit history and income confirmation, tough money finances mainly concentrate on the worth of the collateral residential or commercial property. A lending institution evaluates the residential property's worth, commonly calling for an assessment, to establish the car loan amount.Borrowers typically obtain a percentage of the residential property's value, typically varying from 60% to 75%. The financing terms are generally shorter, commonly in between one to three years, with higher interest rates showing the raised threat for lenders. Settlement structures may vary, with some fundings calling for interest-only settlements throughout the term, adhered to by a balloon payment at the end. The rate of financing is a notable feature, as hard money car loans can commonly be accepted and paid out within days, making them appealing for immediate funding requirements.Advantages of Hard Money Financing

While numerous financing options exist, hard money lending deals distinctive benefits that can be particularly advantageous genuine estate capitalists and those facing urgent monetary requirements. One substantial advantage is the rate of authorization and funding; debtors can typically safeguard lendings within days, permitting quick transactions in competitive markets. Additionally, hard money finances are asset-based, implying approval primarily relies on the worth of the property instead than the debtor's credit history score. This opens possibilities for people with less-than-perfect credit report. Furthermore, lenders are typically a lot more flexible in their terms, suiting distinct situations and financial investment techniques. Finally, tough money financings can supply leverage for capitalists aiming to get residential or commercial properties swiftly, enabling them to profit from profitable bargains that traditional financing might not support. This combination of fast accessibility and flexible terms makes difficult cash offering an eye-catching option for numerous in the realty field.Threats Associated With Difficult Money Financings

Hard money car loans existing numerous integral risks that customers need to consider. High rates of interest can significantly boost the general expense of loaning, while short loan terms might place stress on settlement timelines. These variables can develop monetary stress, making it necessary for prospective debtors to examine their capability to manage such difficulties.

High Rates Of Interest

High rate of interest represent a considerable danger variable in the domain name of tough cash lendings. These car loans typically attract borrowers who may not receive conventional financing, resulting in higher rates that can range from 8% to 15% or more. This raised price can stress the debtor's economic scenario, especially if the finance is not safeguarded with a sensible leave approach. The stress of high settlements can cause default, threatening the consumer's residential or commercial property and investment. In addition, passion prices can rise and fall based upon market problems or loan provider policies, adding uncertainty to the borrower's settlement commitments. Understanding and preparing for these high passion rates is essential for anybody considering difficult money offering as a financing alternative.

Short Financing Terms

Short lending terms are a specifying quality of hard money lendings, usually ranging from a couple of months to a few years. This brevity can posture considerable threats for customers. The minimal timeframe might press consumers to quickly offer the security or refinance, potentially causing financial stress if market problems are unfavorable. Furthermore, the brief duration can result in greater month-to-month payments, which may go beyond the customer's money circulation capabilities. Borrowers risk losing their financial investment if incapable to meet these obligations. Additionally, the necessity to act can lead to hasty decisions, intensifying the possibility for financial errors. Comprehending these threats is vital for any person considering difficult cash finances, guaranteeing informed choices are made in the financing process.Key Considerations for Customers

When taking into consideration difficult money fundings, customers must evaluate numerous vital elements. Rate of interest, car loan terms, and collateral needs play critical duties in figuring out the overall usefulness of the finance. Understanding these facets can considerably influence a consumer's decision-making process and economic results.

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

Passion Prices Influence

Recognizing the effect of rate of interest rates is important for customers considering hard money lendings, as these rates can substantially affect general funding costs. Generally, hard cash finances include higher rate of interest contrasted to typical funding, showing the increased threat taken by lending institutions. Consumers must very carefully examine their financial situation and task go back to figure out if the higher costs line up with their investment approaches. In addition, changing market conditions can additionally affect rate of interest, making it crucial to safeguard a funding when prices agree with. Consumers need to additionally consider the period of the loan and payment capacities, as these elements can significantly affect the overall quantity paid over time. Eventually, recognition of rates of interest effects is essential for notified loaning choices.Loan Terms Described

Loan terms play a necessary duty fit the general experience of consumers looking for hard money financing. These terms normally consist of the finance quantity, settlement duration, and rates of interest, which are important for customers to examine their economic commitments. Tough cash lendings typically feature shorter payment periods compared to traditional fundings, normally ranging from 6 months to three years. Debtors must likewise think about the connected fees, which can range lenders and might influence the overall expense of borrowing. Understanding these terms assists customers make notified decisions and evaluate their ability to pay back the car loan (Hard Money Lenders Atlanta). Eventually, clear comprehension of the lending terms can significantly influence the success of a hard cash offering dealCollateral Requirements Overview

Security demands are an important facet of difficult money lending that consumers need to meticulously think about. Usually, tough cash loans are secured by actual estate, and loan providers expect the home to have a significant worth about the loan quantity. This collateral acts as a safeguard for lenders, enabling them to recover losses in situation of default. Borrowers must realize that the condition and location of the residential or commercial property greatly affect collateral worth. In addition, loan providers might need a residential property evaluation to examine market well worth. Recognizing these demands is essential, as site inadequate security can bring about higher interest prices or rejection of the loan. Eventually, consumers must establish they can satisfy collateral assumptions to safeguard desirable loaning terms.The Application Refine for Hard Cash Loans

Exactly how does one navigate the application process for hard cash financings? The process usually starts with a customer determining a suitable lending institution. After choosing a lending institution, the debtor sends an application, which generally consists of individual info, information regarding the residential property concerned, and the planned use the finance. Unlike conventional lendings, hard this post cash lenders concentrate a lot more on the value of the security instead of the debtor's creditworthiness.Once the application is obtained, the lending institution conducts an appraisal of the residential or commercial property to identify its value. This step is vital, as it influences the lending quantity used. If the assessment fulfills the lender's requirements, they wage the underwriting procedure, which is normally sped up contrasted to conventional lenders. Upon authorization, the debtor gets a lending quote, outlining terms. Ultimately, after consenting to the terms, the consumer indicators the needed papers, and funds are disbursed rapidly, normally within days.Often Asked Inquiries

Can Hard Money Loans Be Utilized for Individual Expenses?

What Sorts Of Feature Get Hard Money Loans?

Different residential or commercial property types get approved for difficult cash finances, including household homes, industrial structures, land, and financial investment residential properties - Hard Money Lenders Atlanta. Lenders usually take into consideration the home's value and possibility for revenue as opposed to the consumer's creditworthinessJust How Quickly Can I Obtain Funds From a Difficult Money Loan Provider?

The rate at which funds can be gotten from a tough money lender normally varies from a couple of days to a week, relying on the loan provider's procedures and the building's assessment. Quick accessibility is a crucial benefit.Are Hard Cash Lendings Regulated by the Federal government?

Tough cash car loans are not greatly regulated by the federal government, unlike typical loans. Lenders frequently operate individually, bring about varying conditions. Customers ought to research certain loan providers to understand their techniques and compliance.Can I Re-finance a Tough Cash Funding Later On?

Re-financing a hard cash lending is possible, depending upon the lender's plans and the debtor's monetary circumstance. Often, customers look for typical funding options after showing boosted credit reliability and building worth admiration. Unlike standard financings, difficult cash car loans are mainly based on the value of the collateral rather than the customer's creditworthiness. Unlike standard financings that rely on credit history scores and income verification, difficult cash lendings largely concentrate on the worth of the collateral building. Short lending terms are a specifying feature of hard money finances, typically ranging from a couple of months to a couple of years (Hard Money Lenders Atlanta). Difficult cash i was reading this lendings frequently feature much shorter repayment durations contrasted to traditional lendings, normally ranging from 6 months to three years. Usually, hard cash financings are safeguarded by real estate, and lenders anticipate the home to have a considerable value loved one to the loan quantityReport this wiki page